Digital Remittance Market Business Status and Future Outlook Analysis 2032

"Executive Summary Digital Remittance Market Size and Share Forecast

CAGR Value

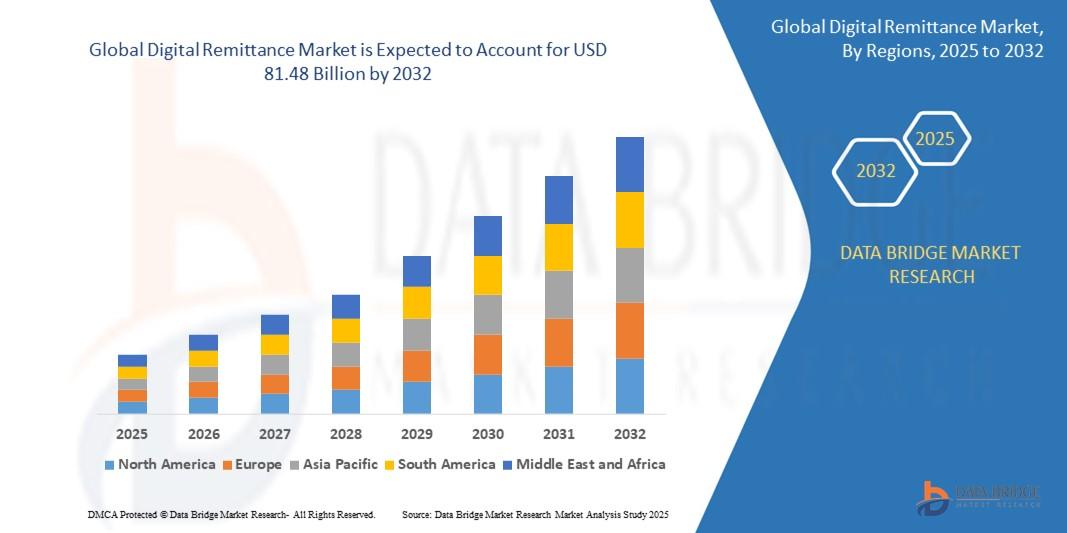

- The global digital remittance market was valued at USD 25.20 billion in 2024 and is expected to reach USD 81.48 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 15.80%, primarily driven by rapid penetration of smartphones and internet services

With a capable and wide-ranging market research study, Digital Remittance Market report provides the facts associated with any subject in the field of marketing. This report unearths the common market conditions, trends, preferences, key players, opportunities, geographical analysis and many other parameters that support to drive the business into right direction. With the precise and high-tech information given in the top notch Digital Remittance Market report, businesses can know about the types of consumers, consumer’s demands and preferences, their perspectives about the product, their buying intentions, their response to particular product, and their varying tastes about the specific product already active in the market.

Digital Remittance Market research report consists of fundamental, secondary and advanced information allied to the global status and trend, market size, sales volume, market share, growth, future trends analysis, segment and forecasts from 2022 - 2029. This report conducts study of market drivers, market restraints, opportunities and challenges underneath market overview which provides valuable insights to businesses for taking right moves. Moreover, the report endows with the data and information for actionable, most recent and real-time market insights which make it uncomplicated to take critical business decisions. Market research analysis lends a hand to businesses for the planning of production, product launches, costing, inventory, purchasing and marketing strategies.

Gain clarity on industry shifts, growth areas, and forecasts in our Digital Remittance Market report. Get your copy:

https://www.databridgemarketresearch.com/reports/global-digital-remittance-market

Digital Remittance Market Review

Segments

- By Type: The digital remittance market can be segmented by type into inward digital remittance and outward digital remittance. Inward digital remittance refers to funds being transferred into a country, while outward digital remittance refers to funds being sent out of a country.

- By Channel: The market can also be segmented by channel into mobile apps, websites, and others. Mobile apps have played a significant role in the growth of digital remittances due to their convenience and ease of use.

- By End-User: Segmentation by end-user includes migrants, expatriates, and others. Migrants and expatriates are key users of digital remittance services as they often need to send money back to their home countries.

Market Players

- PayPal Holdings, Inc.: PayPal is a major player in the digital remittance market, offering services that enable users to send and receive money internationally.

- Remitly: Remitly is a digital remittance company that focuses on providing affordable and secure money transfer services to customers around the world.

- Western Union Holdings, Inc.: Western Union is a well-established player in the remittance industry, offering both digital and traditional money transfer services.

- WorldRemit Ltd.: WorldRemit is a digital money transfer service that allows users to send money to family and friends in over 150 countries.

- TransferWise Ltd.: TransferWise is a digital payment platform that enables users to send money internationally at a low cost using real exchange rates.

The global digital remittance market is witnessing significant growth due to factors such as increasing international migration, advancements in technology, and the growing demand for fast and secure cross-border money transfer services. The market is expected to continue expanding as more consumers embrace digital solutions for sending money to loved ones in different parts of the world. Mobile apps have emerged as a popular channel for digital remittances, providing users with a convenient way to transfer funds quickly and securely. Additionally, the rise of blockchain technology has further enhanced the efficiency and transparency of digital remittance transactions.

Key market players such as PayPal, Remitly, Western Union, WorldRemit, and TransferWise are actively innovating to stay competitive in the digital remittance space. These companies are focusing on improving user experience, expanding their global reach, and enhancing the security of their platforms to attract more customers. Partnerships with financial institutions and mobile wallet providers are also helping market players broaden their service offerings and reach a wider audience.

Overall, the global digital remittance market presents lucrative opportunities for players in the financial services sector. With increasing globalization and the need for efficient cross-border money transfer solutions, the market is poised for continued growth in the coming years.

The global digital remittance market is set to witness a transformation in the coming years driven by various factors reshaping the industry landscape. One of the emerging trends in the market is the focus on enhancing security measures to safeguard against cyber threats and to instill trust among users. With the increasing popularity of digital remittance services, ensuring the safety of transactions and customer data has become paramount for market players to maintain a competitive edge.

Moreover, the integration of artificial intelligence (AI) and machine learning in digital remittance platforms is anticipated to streamline operations and improve efficiency. By leveraging AI algorithms, remittance providers can enhance fraud detection, automate compliance tasks, and offer personalized services to users based on their transaction history and preferences. This technological advancement is poised to revolutionize the overall remittance experience for both senders and recipients.

Another key development in the digital remittance market is the expansion of partnerships and collaborations between fintech companies, traditional financial institutions, and mobile service providers. These strategic alliances enable remittance providers to access new markets, leverage existing customer bases, and offer innovative services such as mobile wallet integration and instant money transfers. By joining forces with various stakeholders in the financial ecosystem, companies in the digital remittance space can drive growth and differentiation in a highly competitive market environment.

Furthermore, the rise of decentralized finance (DeFi) and blockchain technology is opening up new possibilities for cross-border payments and remittance services. Blockchain-based solutions offer increased transparency, lower transaction costs, and faster settlement times compared to traditional banking systems. As the adoption of blockchain technology continues to grow, we can expect digital remittance providers to explore innovative use cases and develop secure, decentralized payment networks to cater to the evolving needs of global customers.

In conclusion, the global digital remittance market is undergoing a phase of rapid transformation driven by technological advancements, changing consumer preferences, and evolving regulatory landscapes. Market players that adapt to these trends, embrace innovation, and focus on enhancing customer experience are likely to succeed and thrive in the dynamic remittance industry. With the continued digitization of financial services and the emergence of new technologies, the future of digital remittance holds immense potential for growth, disruption, and value creation for stakeholders across the ecosystem.The global digital remittance market is experiencing a paradigm shift driven by technological innovations, changing consumer behaviors, and strategic partnerships among key industry players. One notable trend shaping the market landscape is the heightened focus on cybersecurity measures to combat cyber threats and bolster user trust. As digital remittance services gain popularity, ensuring the security of transactions and user data becomes paramount for market participants to maintain a competitive edge. By prioritizing robust security protocols, companies can mitigate risks and enhance the overall reliability of their platforms, thereby fostering long-term customer loyalty and retention.

Additionally, the integration of artificial intelligence (AI) and machine learning in digital remittance platforms is poised to revolutionize operational efficiency and customer experience. AI-powered algorithms can significantly improve fraud detection mechanisms, automate compliance procedures, and enable personalized services based on individual transaction patterns and preferences. This technological advancement not only streamlines remittance processes but also enhances the overall user journey, positioning companies for sustainable growth and differentiation in a rapidly evolving market environment.

Furthermore, collaborations and partnerships between fintech firms, traditional financial institutions, and mobile service providers are reshaping the competitive landscape of the digital remittance market. By leveraging these strategic alliances, remittance providers can access new markets, tap into existing customer bases, and introduce innovative services such as mobile wallet integration and instant money transfers. Through synergistic efforts with industry stakeholders, companies in the digital remittance sector can expand their reach, drive customer acquisition, and deliver enhanced value propositions to meet evolving market demands effectively.

The emergence of decentralized finance (DeFi) and blockchain technology represents a disruptive force in the digital remittance ecosystem, offering unprecedented opportunities for cross-border payments and financial inclusion. Blockchain-based solutions not only enhance transaction transparency and reduce costs but also facilitate faster settlement times compared to traditional banking channels. As blockchain adoption continues to accelerate, digital remittance providers are poised to explore novel use cases and develop secure, decentralized payment networks that cater to the evolving needs of a global customer base. By embracing blockchain innovation, market players can unlock new avenues for growth, efficiency, and market differentiation in an era characterized by digital transformation and technological advancement.

In conclusion, the global digital remittance market is undergoing rapid evolution driven by technological advancements, shifting consumer preferences, and collaborative ventures among industry stakeholders. Companies that adeptly navigate these trends, foster innovation, and prioritize customer-centric strategies are well-positioned to thrive in a dynamic and competitive remittance landscape. With a relentless focus on cybersecurity, AI integration, strategic partnerships, and blockchain adoption, digital remittance providers can harness the immense potential of the market, drive value creation, and deliver superior financial services that resonate with the needs of a digitally empowered global audience.

Uncover the company’s portion of market ownership

https://www.databridgemarketresearch.com/reports/global-digital-remittance-market/companies

Structured Market Research Questions for Digital Remittance Market

- What is the competitive positioning of leading brands?

- What export regulations affect the Digital Remittance Market?

- What is the market share by sales channel (retail, online)?

- How are consumer expectations evolving?

- What product attributes are most valued?

- Which regions face supply chain constraints?

- What funding trends are visible in this Digital Remittance Market?

- How do regional taxes affect pricing?

- What are the projected risks in the Digital Remittance Market?

- What collaborations exist between public and private sectors?

- What role does influencer marketing play in Digital Remittance Market?

- How do cultural factors impact Digital Remittance Market trends?

- How is the resale or second-hand Digital Remittance Market performing?

- What’s the churn rate in consumer loyalty?

Browse More Reports:

Global Bonsai Market

Global Raman Spectroscopy Market

Global Silicon Fertilizer Market

Global Baby Carrier Market

Global Natural Rubber Market

Global Wearable Electrocardiogram (ECG) Monitors Market

Global Baggage Handling System Market

Global All-Flash Array Market

Global Digital Remittance Market

Global Sodium Bicarbonate Market

Global Phosphate Fertilizers Market

Europe Water Sink Market

U.S. Social Determinants of Health (SDOH) Market

Saudi Arabia Personal Protective Equipment (PPE) Market

North America Olive Oil Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness