Digital Remittance Market Emerging Insights and Trends 2032

"Executive Summary Digital Remittance Market: Growth Trends and Share Breakdown

CAGR Value

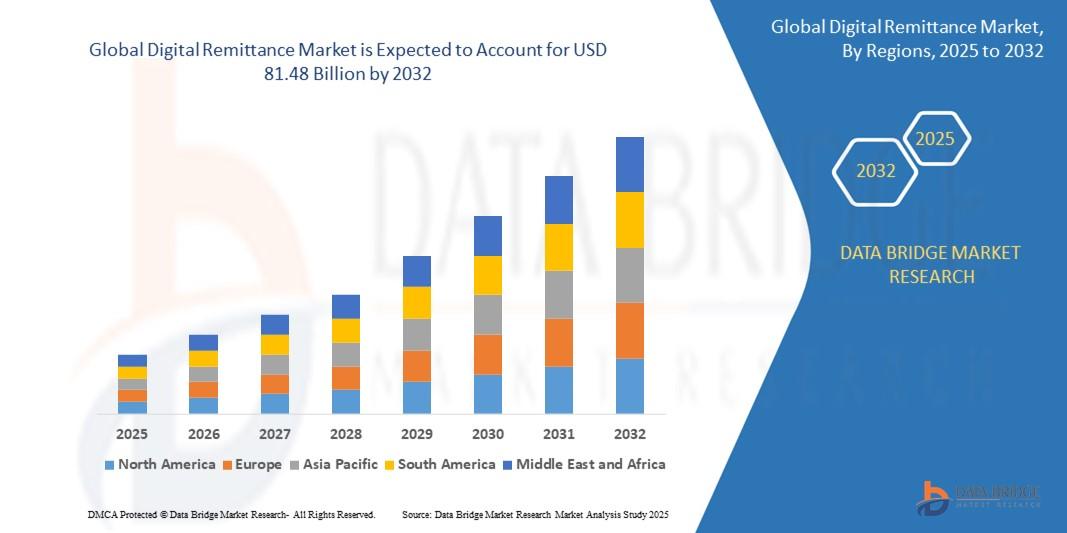

- The global digital remittance market was valued at USD 25.20 billion in 2024 and is expected to reach USD 81.48 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 15.80%, primarily driven by rapid penetration of smartphones and internet services

This Digital Remittance Market research report is a proven and consistent source of information that gives telescopic view of the existing market trends, emerging products, situations and opportunities that drives your business towards the success. Market segmentation studies conducted in this report with respect to product type, applications, and geography are valuable in taking any verdict about the products. Digital Remittance Market report also provides company profiles and contact information of the key market players in the key manufacturer’s section. Gaining valuable market insights with the new skills, latest tools and innovative programs is sure to help your business achieve business goals.

The Digital Remittance report provides CAGR value fluctuations during the forecast period of 2018-2025 for the market. It encompasses a methodical investigation of the current scenario of the global market, which covers several market dynamics. The report provides wide-ranging statistical analysis of the market’s continuous positive developments, capacity, production, production value, cost/profit, supply/demand, and import/export. No stone is left unturned while researching and analysing data to prepare market research report like this one and the others. To get knowledge of all the above factors, this Digital Remittance Market report is created that is transparent, extensive, and supreme in quality.

Get a full overview of market dynamics, forecasts, and trends. Download the complete Digital Remittance Market report: https://www.databridgemarketresearch.com/reports/global-digital-remittance-market

Digital Remittance Market Summary

Segments

- By Remittance Channel: The digital remittance market can be segmented based on the remittance channel, including banks, money transfer operators, online platforms, and others. Banks hold a significant share in the market as they offer secure and reliable transfer services for customers globally. Money transfer operators also play a crucial role in facilitating digital remittance transactions, especially in regions where access to traditional banking services is limited.

- By End-User: The market can also be segmented by end-user, including personal and business users. Personal users make up a substantial portion of the digital remittance market as they use these services for sending money to family and friends across borders. On the other hand, business users utilize digital remittance services for commercial purposes such as paying suppliers or employees in different countries.

- By Region: Geographically, the global digital remittance market can be segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Asia Pacific dominates the market due to the high volume of remittance transactions in countries like India, China, and the Philippines. North America and Europe also contribute significantly to the market growth with the increasing adoption of digital payment solutions.

Market Players

- Western Union: As one of the largest players in the digital remittance market, Western Union offers a wide range of digital transfer services to individuals and businesses worldwide. The company's extensive network and brand reputation make it a preferred choice for many customers.

- MoneyGram: MoneyGram is another key player in the digital remittance market, providing fast and secure money transfer services through digital channels. The company's strategic partnerships and innovative technology solutions have helped it maintain a competitive edge in the market.

- Remitly: Remitly is a well-known player in the digital remittance space, focusing on delivering convenient and cost-effective transfer options for customers. The company's user-friendly platform and competitive exchange rates have attracted a large customer base, especially among migrant populations.

- Ria Financial Services: Ria Financial Services is a global remittance company that offers digital transfer services to customers worldwide. With a focus on accessibility and affordability, Ria has established itself as a trusted provider in the remittance market.

The global digital remittance market is poised for significant growth in the coming years, driven by the increasing adoption of digital payment solutions and the growing need for efficient cross-border transfer services. As technology continues to evolve and customer preferences shift towards digital platforms, market players will need to innovate and collaborate to stay competitive in this dynamic landscape.

DDDDDThe digital remittance market is experiencing a transformation propelled by technological advancements and changing consumer behaviors. One key trend shaping the market is the increasing integration of artificial intelligence and blockchain technology to enhance security, reduce transaction costs, and improve transaction speeds. These innovations are revolutionizing the way remittance transactions are conducted, offering a more seamless and efficient experience for both individuals and businesses. Additionally, the rise of mobile payment solutions and digital wallets is enabling users to send and receive money conveniently through their smartphones, further driving the growth of the digital remittance market.

Another significant trend in the digital remittance market is the growing emphasis on financial inclusion, particularly in developing economies where access to traditional banking services is limited. Digital remittance services provide a lifeline for individuals in underserved communities, allowing them to receive money from loved ones abroad and access essential financial services. Market players are increasingly focusing on expanding their reach to these regions by partnering with local financial institutions and leveraging mobile technology to offer inclusive and affordable remittance solutions to unbanked populations.

Furthermore, regulatory developments are shaping the landscape of the digital remittance market, with governments worldwide implementing policies to enhance transparency, reduce fraud, and protect consumers' interests. Compliance with regulatory requirements is paramount for market players to build trust among customers and ensure the security of cross-border transactions. As the regulatory environment evolves, companies in the digital remittance sector will need to stay abreast of changes and adapt their operations to meet compliance standards while maintaining seamless customer experiences.

Moreover, the competitive landscape of the digital remittance market is intensifying as new entrants and fintech startups enter the space, offering innovative solutions and disrupting traditional players. Collaboration and strategic partnerships are becoming essential for established companies to drive innovation, expand their service offerings, and cater to the evolving needs of customers. By leveraging advanced technologies, data analytics, and customer insights, market players can differentiate themselves in a crowded market and capture new growth opportunities.

In conclusion, the digital remittance market is poised for continued growth and innovation, driven by technological advancements, changing consumer preferences, and evolving regulatory landscapes. Market players that can adapt to these trends, embrace digital transformation, and prioritize customer-centric solutions will be well-positioned to succeed in this dynamic and competitive marketplace.The digital remittance market continues to evolve with technological advancements and changing consumer behaviors shaping its trajectory. One emerging trend is the increasing integration of artificial intelligence and blockchain technology, enhancing security, reducing transaction costs, and improving transaction speeds. These advancements are revolutionizing the way remittance transactions are conducted, offering a more convenient and efficient experience for both individuals and businesses. The rise of mobile payment solutions and digital wallets further accelerates market growth by enabling users to send and receive money seamlessly through their smartphones.

Financial inclusion is another significant trend driving the digital remittance market, particularly in developing economies with limited access to traditional banking services. Digital remittance services act as a crucial link for individuals in underserved communities, providing access to essential financial services and enabling them to receive money from abroad. Market players are expanding their reach in these regions through partnerships with local financial institutions and leveraging mobile technology to offer inclusive and affordable remittance solutions to the unbanked populations.

Regulatory developments also play a pivotal role in shaping the digital remittance landscape globally. Governments are implementing policies to enhance transparency, reduce fraud, and protect consumer interests. Compliance with these regulations is essential for market players to build trust among customers and ensure the security of cross-border transactions. Companies in the digital remittance sector need to stay updated on regulatory changes and adjust their operations to meet compliance standards while maintaining a seamless customer experience.

The competitive landscape of the digital remittance market is intensifying with the entry of new players and fintech startups offering innovative solutions and disrupting traditional providers. Established companies are increasingly focusing on collaboration and strategic partnerships to drive innovation, expand service offerings, and meet evolving customer needs. By leveraging advanced technologies, data analytics, and customer insights, market players can differentiate themselves in a competitive market environment and capitalize on emerging growth opportunities.

In conclusion, the digital remittance market is on a growth trajectory driven by technology, financial inclusion initiatives, regulatory developments, and intense competition. Adapting to these trends, embracing digital transformation, and prioritizing customer-centric solutions will be crucial for market players to thrive in this dynamic and ever-evolving landscape.

Examine the market share held by the company

https://www.databridgemarketresearch.com/reports/global-digital-remittance-market/companies

Digital Remittance Market Research Questionnaire – 25 Sets of Analyst Questions

- What is the estimated revenue of the global Digital Remittance Market?

- What are the future growth projections for the Digital Remittance Market?

- What are the major types and applications in the Digital Remittance Market segmentation?

- Who are the major companies analyzed in the Digital Remittance Market report?

- Which country-level data is included in theDigital Remittance Market research?

- Which organizations hold significant influence in the Digital Remittance Market?

Browse More Reports:

Europe Benign Prostatic Hyperplasia Devices Market

Middle East and Africa Benign Prostatic Hyperplasia Devices Market

North America Benign Prostatic Hyperplasia Devices Market

Europe Bakeware Market

Asia-Pacific Bakeware Market

North America Bakeware Market

Middle East and Africa Bakeware Market

Asia-Pacific Ataxia Market

Europe Ataxia Market

Middle East and Africa Ataxia Market

North America Ataxia Market

Asia-Pacific Animal Feed Organic Trace Minerals Market

Europe Animal Feed Organic Trace Minerals Marke

Middle East and Africa Animal Feed Organic Trace Minerals Market

North America Animal Feed Organic Trace Minerals Market

Asia-Pacific Adenomyosis Drugs Market

Europe Adenomyosis Drugs Market

Middle East and Africa Adenomyosis Drugs Market

North America Adenomyosis Drugs Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"

- Sanat

- Sosyal Nedenler

- El Sanatları

- Dans

- İçecekler

- Film

- Fitness

- Yiyecek

- Oyunlar

- Bahçecilik

- Sağlık

- Ana Sayfa

- Edebiyat

- Müzik

- Ağ Kurma

- Diğer

- Parti

- Din

- Alışveriş

- Spor

- Tiyatro

- Sağlıklı Yaşam