MENA Fintech Market Size, Growth, Trends, Forecast (2023-2030)

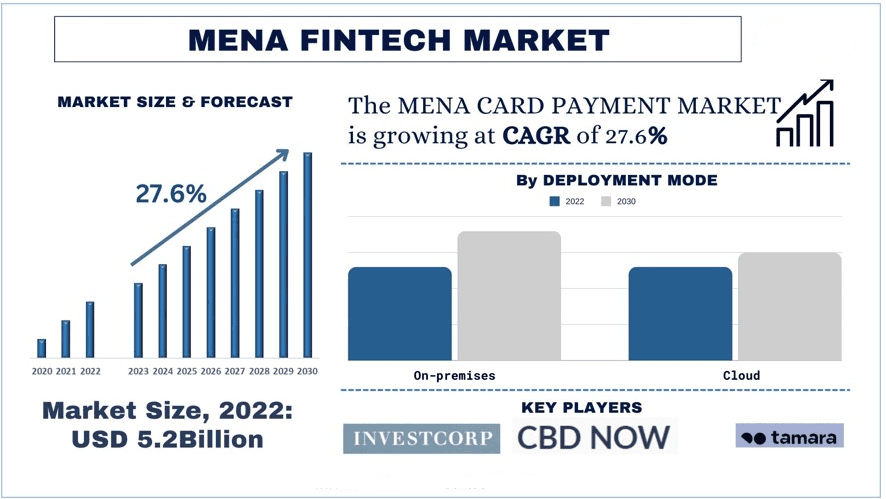

The MENA Fintech Market was valued at USD 5,274.26 million in the year 2022 and is expected to grow at a strong CAGR of around 27.6% during the forecast period.

The Middle East and North Africa (MENA) region is experiencing a digital revolution, with fintech emerging as a catalyst for innovation and transformation in the financial services industry. Fintech, short for financial technology, encompasses a diverse range of technological innovations aimed at enhancing efficiency, accessibility, and inclusivity in financial services. In recent years, the MENA fintech market has witnessed exponential growth, driven by factors such as increasing internet and smartphone penetration, a young and tech-savvy population, and government initiatives promoting digital transformation.

Fintech Demand in MENA:

The demand for fintech solutions in the MENA region is propelled by several factors. Firstly, there is a growing appetite for digital financial services among consumers, driven by convenience, accessibility, and the desire for financial inclusion. With a large unbanked population and limited access to traditional banking services, FinTech offers a lifeline for millions of individuals and businesses seeking affordable and user-friendly financial solutions. Moreover, the COVID-19 pandemic has accelerated the adoption of digital payments and online banking, further fueling demand for fintech services in the region.

Cost

The cost-effectiveness of fintech solutions is another driving force behind their adoption in the MENA region. Compared to traditional banking services, fintech offerings often come with lower fees, reduced transaction costs, and greater transparency. This makes fintech particularly attractive to underserved populations, small and medium-sized enterprises (SMEs), and emerging startups looking to streamline their financial operations and access capital more efficiently. Additionally, the scalability and flexibility of fintech solutions allow organizations to adapt to changing market dynamics and scale their operations cost-effectively.

Access sample report (including graphs, charts, and figures) - https://univdatos.com/reports/mena-fintech-market?popup=report-enquiry

Applications:

Fintech in the MENA region encompasses a wide array of applications across various sectors. One of the most prominent areas of fintech innovation is digital payments. Mobile payment apps, contactless payment technologies, and peer-to-peer payment platforms are revolutionizing the way people transact, driving financial inclusion and economic growth. Additionally, fintech solutions in areas such as insurance, lending, wealth management, and remittances are gaining traction, offering tailored products and services to meet the diverse needs of consumers and businesses.

Recent Developments/Awareness Programs: - Several key players and governments are rapidly adopting strategic alliances, such as partnerships, or awareness programs for the treatment: -

· Qatar-basedFintech KARTY has raised a Seed funding round of 2 million USD from local investors.

· As of 2023, more than 83% of Kuwaitis are willing to adoptFintech solutions.

· In Jan 2024, The Qatar Investment Authority (QIA) established a 200 million USD fund in partnership with the Ashmore Group. The fund, known as the Ashmore Qatar Equity Fund, aims to provide foreign and local investors with exposure to Qatar's fast-developing economy and access to Ashmore's investment expertise.

In conclusion, the MENA Fintech market presents a wealth of opportunities for firms seeking to capitalize on the region's economic growth and rising affluence. With increasing demand for sophisticated financial services, driven by high-net-worth individuals, aging populations, and digital transformation, Fintech firms are well-positioned to expand their offerings and tap into new market segments. By embracing innovation, leveraging digital technologies, and fostering strategic partnerships, Fintech firms can navigate the complexities of the MENA market and unlock sustainable growth in the years to come.

Key Offerings of the Report

Market Size, Trends, & Forecast by Revenue | 2023−2030.

Market Dynamics – Leading Trends, Growth Drivers, Restraints, and Investment Opportunities

Market Segmentation – A detailed analysis by Deployment Mode and Application

Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Contact Us:

Email - contact@univdatos.com

Website - www.univdatos.com

- Sanat

- Sosyal Nedenler

- El Sanatları

- Dans

- İçecekler

- Film

- Fitness

- Yiyecek

- Oyunlar

- Bahçecilik

- Sağlık

- Ana Sayfa

- Edebiyat

- Müzik

- Ağ Kurma

- Diğer

- Parti

- Din

- Alışveriş

- Spor

- Tiyatro

- Sağlıklı Yaşam